Invest Beautifully

The blessing and burdens of wealth - we’re with you for both.

We integrate, coordinate, and manage the complexity for you…

…so that your complexity is reduced to one call

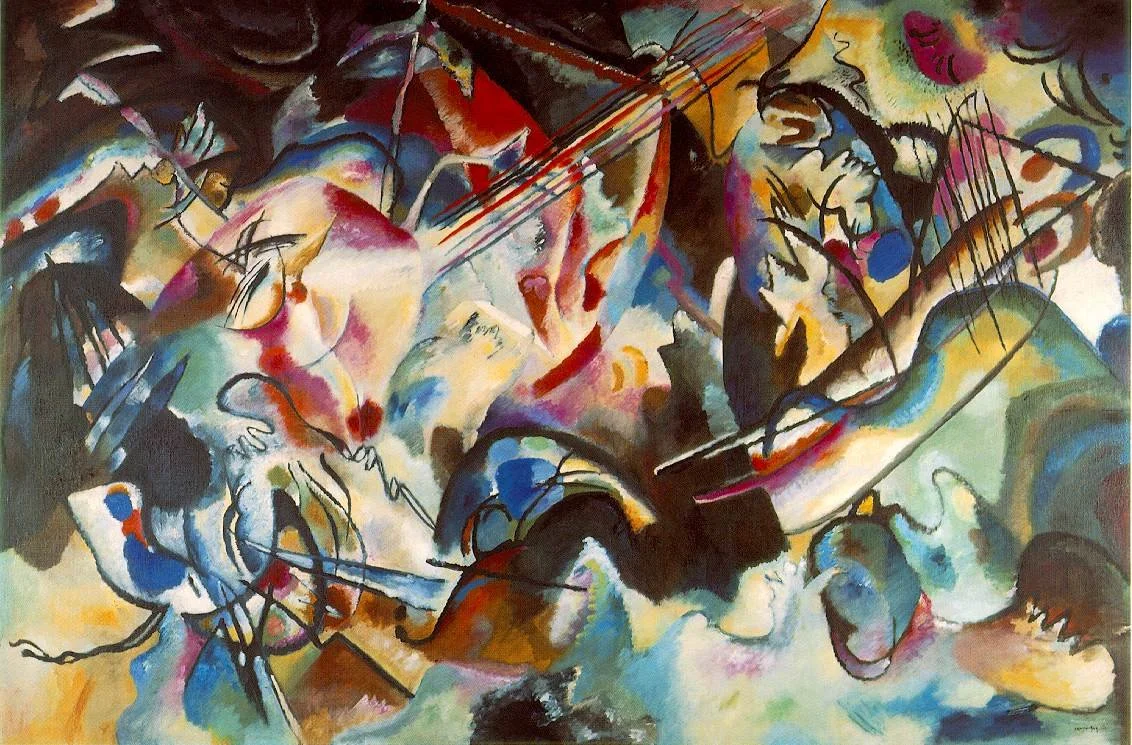

Our role is to minimize the burdens and complexity of your wealth. Our personal complexity management is the feature most valued by our clients. We get to know you multi-dimensionally, at first, and over the years. We see you as unique. We would not want a corporate profit-maximizing assembly line approach guiding our family’s financial lives. We take the approach of the artist who, though he or she uses the same available tools, creates one-of-a kind experiences with thought and with care.

We take this privilege and responsibility personally.

Personal Complexity Management Means…

-

Going Both Wide And Deep

There’s a LOT to manage and make decisions on that requires robust and personalized financial analysis

→ Held Away Private Investments

→ Multiple Properties & Collectibles

→ Personal Businesses

→ Held Away Stock Options

→ Held Away 401ks

→ Held Away Insurance Products

→ Multiple Checking Accounts

→ Held Away Outside Public Investments

→ Personal Valuables Of Significant Worth -

Understanding & Helping You Manage Family Wealth Dynamics

This means seeing each person as unique and working creatively with each person individually

→ Family Goal-Setting

→ Next-Generation Education Toward Finances

→ Investments

→ Banking

→ Wealth Management -

Bringing Order & Simplification To Disparate Parts Of Your Financial World

And identifying and managing specialists tailored to your family goals

→ Tax Advisors

→ Estate Attorneys

→ Business Counselors

→ Agents/Managers

→ Insurance Professionals

→ Bankers

→ Capital Call Administrators

→ Distribution Administrators

→ 529 Plan & 401k Administrators